More than 126,000 Colorado taxpayers chose to pay a tax penalty instead of getting health insurance in 2015, according to a new Colorado Health Institute analysis.

That equates to 4.8 percent of Coloradans who filed a tax return in 2015 — a percentage that is slightly above the national average of 4.4 percent.

That equates to 4.8 percent of Coloradans who filed a tax return in 2015 — a percentage that is slightly above the national average of 4.4 percent.

The Affordable Care Act (ACA) requires most people to have health insurance. Those who don’t must pay a fine when they file their annual income taxes. (The ACA allows a number of hardship exemptions to avoid the mandate.) The law also provides incentives to get insured — either free coverage through expanded Medicaid eligibility or subsidized private insurance for people making less than four times the federal poverty level, which was about $47,000 for a single person in 2015.

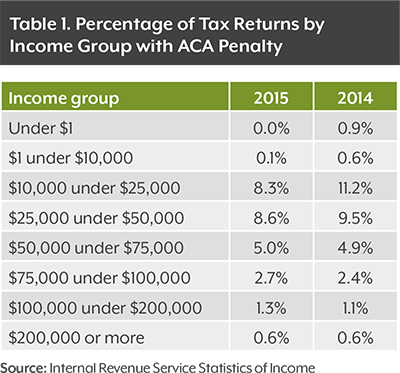

The number of Coloradans who paid the penalty dropped in 2015 compared with the year before, when the major parts of the ACA took effect. The majority of the 126,000 who paid the penalty reported less than $50,000 income, meaning they likely would have qualified for free or cut-price health coverage.

However, for most people the penalty cost less than annual premiums for the cheapest available insurance plan, even with the subsidy.

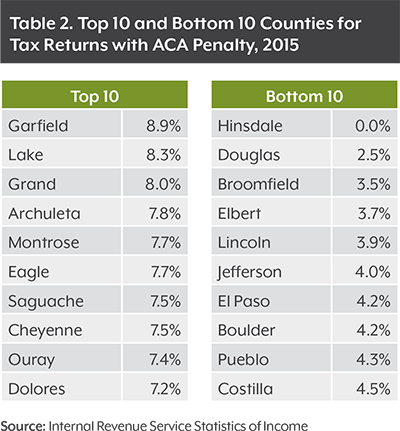

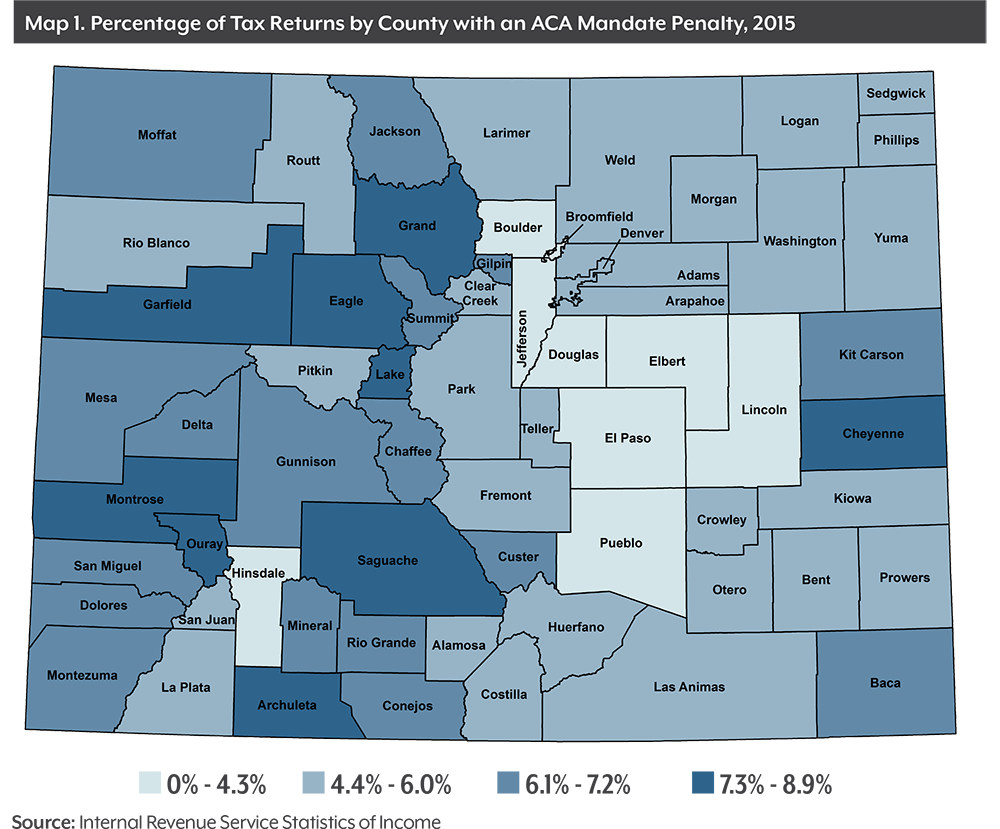

Counties in rural Colorado, where insurance prices on the individual market are especially high, had higher rates of residents choosing to pay the penalty than the state average.

Source and Methodology

This analysis uses the Internal Revenue Service’s (IRS) Statistics of Income1 to find the number of Coloradans who paid the ACA penalty, their incomes and their county of residence. The IRS compiles Statistics of Income based on a sampling of individual income tax returns. ACA data are available from 2015 and 2015.

Data and percentages in this paper are based on number of tax returns filed. Not everyone files a tax return. In Colorado, there were 2.55 million tax returns filed in 2014 and 2.61 million in 2015.

The IRS data is available for download on here on the Colorado Health Institute website.

Fewer People Skip Insurance When Penalties are Higher

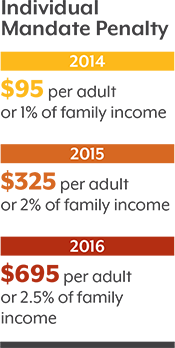

When the individual mandate went into effect in 2014, the tax penalty was $95 per adult or one percent of family income, whichever was greater. The penalty increased in 2015 to $325 per adult or two percent of family income, whichever was greater. The current penalty for 2016 is $695 per adult or 2.5 percent of income, whichever is greater.

When the penalty increased in 2015, the number of Colorado taxpayers who paid it dropped by nearly 19,000 — from the 145,000 who paid it in 2014 — despite slightly higher insurance prices in 2015. If this pattern holds, the 2016 data should show another drop in the number of people who paid the penalty, because the size of the penalty increased that year.

However, 2016 also was the beginning of dramatic price increases on individual market across the state. Premium prices in western Colorado were already among the highest in the country in 2014 and 2015.