Higher Fines, More Compliance: Fewer Coloradans Pay ACA Penalty

Key Takeaways

As the tax penalty for being uninsured increased between 2014 and 2016, fewer Coloradans passed up health insurance.

Most Colorado taxpayers who paid the penalty were likely eligible for subsidized health insurance or Medicaid.

The penalty has been repealed for 2019, making the current open enrollment period the first one without the mandate.

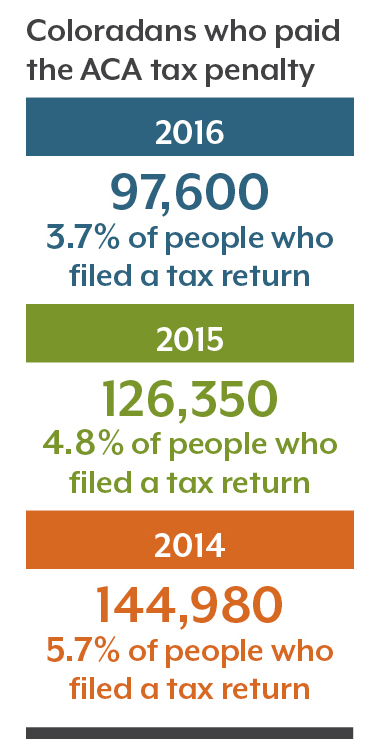

That equates to 3.7 percent of Coloradans who filed a tax return in 2016 — slightly more than the national rate of 3.3 percent.

However, the number of Coloradans paying the penalty dropped steadily each year between 2014 and 2016. The penalty itself became substantially more expensive over that time period.

That suggests that the penalty appears to have worked as designed by incentivizing more people to get insured and avoid the fine.

The Affordable Care Act (ACA) requires most people to have health insurance. Until 2018, those who didn’t comply paid a fine when they filed their annual income taxes. The ACA allowed a few exemptions for hardships such as homelessness or bankruptcy.

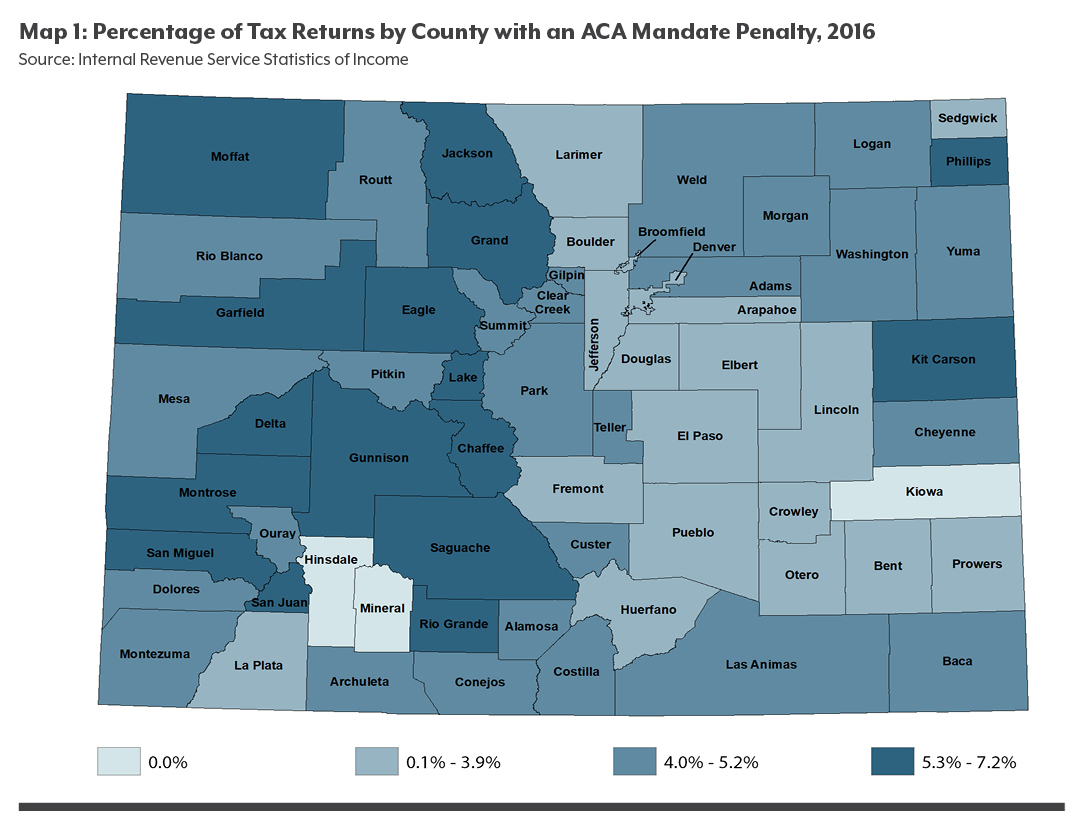

In 2016, counties in rural Colorado, where insurance prices on the individual market are especially high, had higher rates of residents choosing to pay the penalty than in the state as a whole.

However, even the rate in rural Colorado fell in 2016 as more residents signed up for health insurance.

The most notable gains were in Mineral and Kiowa counties, where no taxpayers paid the penalty in 2016, and in Ouray County, where the rate of people paying the penalty dropped from 7.4 percent in 2015 to 4.4 percent in 2016.

Congress repealed this penalty in 2018. Beginning in 2019, people will no longer have to pay if they forego health insurance.

Source and Methodology

This analysis uses data from the IRS Statistics of Income program showing the number of Coloradans who paid the ACA penalty, their incomes, and their county of residence. The IRS compiles Statistics of Income each year based on a sampling of individual income tax returns.

Fewer People Skip Insurance When Penalties Are Higher

When the individual mandate went into effect in 2014, the tax penalty for noncompliance was $95 per adult or 1 percent of family income, whichever was greater. The penalty increased in 2015 to $325 per adult or 2 percent of family income, whichever was greater. It increased again in 2016 to $695 per adult or 2.5 percent of income, whichever was greater, and remained the same in 2017 and 2018. Congress repealed the penalty effective January 1, 2019.

When the penalty increased in 2015, the number of Colorado taxpayers who paid it dropped by nearly 19,000 — from 144,980 in 2014 to 126,350 in 2015 — despite slightly higher insurance prices in 2015. In 2016, nearly 29,000 fewer Coloradans paid a penalty, correlating with the penalty increase that year.

More Coloradans were insured in 2016 than in 2015, even though 2016 brought dramatic price increases on the individual market across the state.

Premium prices in western Colorado were already among the highest in the country in 2014 and 2015. For example, in 2015 the lowest-cost silver plan premium for a 40-year-old in western Colorado was $249 a month. In 2016, the monthly premium for lowest-cost silver plan the same individual went up by nearly 40 percent to $346.

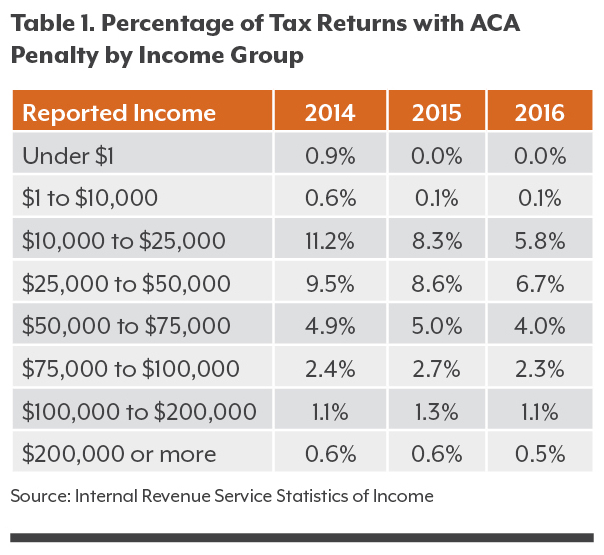

Most Coloradans Who Pay the Penalty Make Less Than $50,000

For many lower-income Coloradans, health insurance can seem like a luxury when bills come in for housing, food, child care, and more. Yet Coloradans with incomes below $50,000, and particularly those with incomes below $25,000, were the most responsive to the higher penalty in 2016. Of those with incomes between $10,000 and $25,000, approximately 5.8 percent in this paid a fine in 2016, compared with 8.3 percent the year before. The rate also decreased for residents with incomes between $25,000 and $50,000, to 6.7 percent in 2016 from 8.6 percent in 2015.

However, a larger proportion of these income groups still pay the penalty compared with wealthier Coloradans or with the state as a whole.

The IRS does not report income data at the same thresholds that are used to determine eligibility for Medicaid and insurance premium tax credits.

However, Coloradans on the lower side of the income scale might qualify for Medicaid, while many of the rest might be eligible for tax credits to reduce the price of private coverage purchased on the state’s health insurance exchange, Connect for Health Colorado.

People with incomes up to 138 percent of the federal poverty level (FPL), or about $16,000 for an individual, would be eligible for Medicaid if they meet other requirements. The cutoff for tax credits is 400 percent of the FPL, or about $47,500 for an individual in 2016. Family thresholds are higher.

The average monthly cost of a subsidized bronze plan for an individual in 2015 was $126, or $1,512 annually, according to Connect for Health Colorado. The cost for the same plan rose to $388 without subsidies in 2016. An increase in subsidies dropped the average cost of a subsidized bronze plan for an individual to $112, or $1,344 annually.

Penalty Hits Western Slope the Hardest

Nine of the 10 counties with the highest rate of penalty payers are on the Western Slope rating area, which has the state’s highest prices on the individual market. Garfield, Lake and Montrose counties top the list.

Six of the 10 counties with the lowest proportion of taxpayers paying the penalty are on the Front Range. In 2016, just 1.9 percent of Douglas County taxpayers paid the fine. Elbert and Broomfield counties weren’t far behind, at 2.3 percent and 2.9 percent, respectively.

In rural Hinsdale County, no taxpayers paid the ACA penalty in 2015 or 2016. Kiowa and Mineral counties also had no taxpayers pay the penalty in 2016.

Colorado had higher rates of penalty payers than the national as a whole. In 2016, 5 million of 150.3 million tax filers nationwide — 3.3 percent — paid the penalty. In Colorado, 97,600 of 2.6 million filers — 3.7 percent — paid the fine. Colorado had the 11th-highest percentage of taxpayers paying the penalty in 2016.

What’s Next?

For nearly 100,000 Coloradans weighing whether to buy insurance or pay the penalty, the cost-benefit calculation came down in favor of paying the penalty. However, fewer Coloradans paid the fine when it jumped to $695 in 2016, which suggests that the fine was effective in convincing some consumers to get covered.

While data on the tax penalty is not yet available for 2017 or 2018, insurance enrollment reached a record high in 2017, suggesting that most Coloradans maintained their health insurance.

The question now is what will happen to the insurance market in 2019, when consumers are no longer required to pay a fine.

Will Coloradans continue to purchase health insurance plans, or will enrollment drop?

There’s reason to believe many consumers will hold onto their coverage. Prices on the individual market for 2019 coverage have stabilized, and many customers will be able to find less expensive plans than in 2018. Some will qualify for free bronze plans — the lowest-cost option — thanks to higher subsidies.

The 2019 open enrollment period, during which people purchase insurance plans, ends on January 15, 2019. How 2019’s enrollment numbers compare to previous years’ will help iluminate just how effective the individual mandate really was at encouraging Coloradans to purchase health insurance.