Note: This report is based upon a 2018 version of reinsurance legislation. For highlights of the 2019 version, read this blog.

State lawmakers, who have searched for years for ways to control the skyrocketing costs of insurance premiums in rural Colorado, are considering an idea that is gaining national momentum — reinsurance.

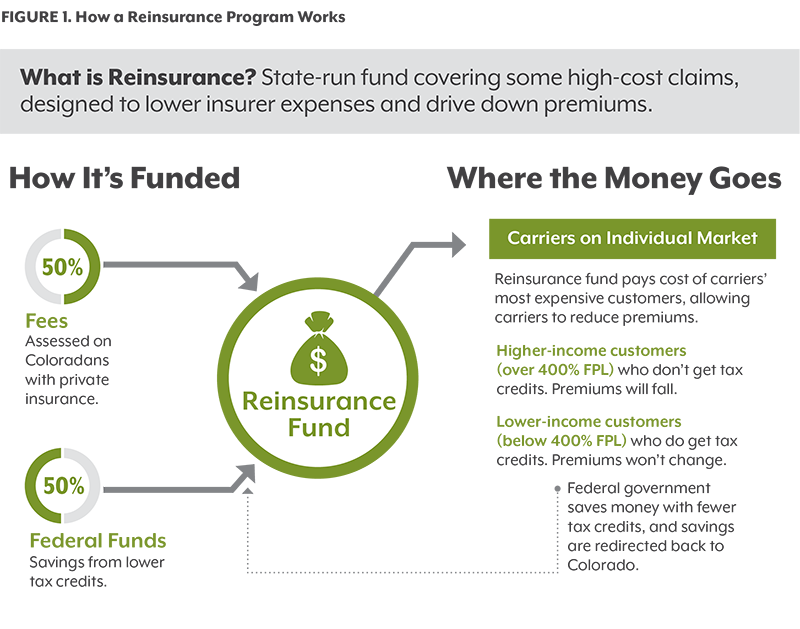

Reinsurance is basically insurance for insurance carriers. The state-run program would cover some of the costs of the most expensive health care consumers on the individual market, reducing insurers’ expenses and lowering premiums that state regulators allow them to charge customers.

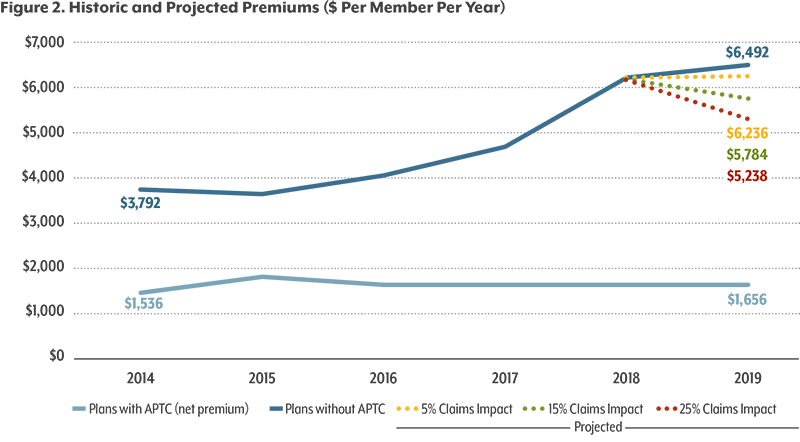

Early estimates suggest that reinsurance could reduce premiums by about 20 percent in the individual market, where people who are self-employed or don’t have insurance through an employer or public program buy coverage.

Individual market customers who would benefit the most are the ones who have suffered the most from recent price increases — those who do not qualify for federal tax credits under the Affordable Care Act (ACA).

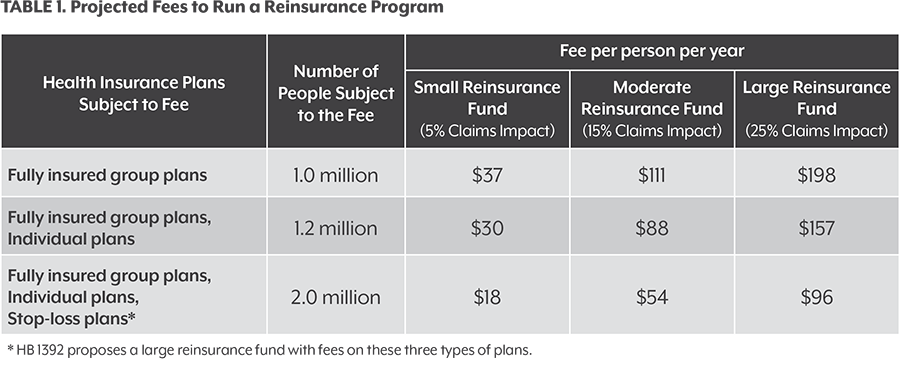

About half of the funding for reinsurance would come from fees on insurance policies, resulting in higher prices for many other consumers. The remaining funding would result from lower premiums, which would save the federal government money it spends on ACA subsidies for eligible consumers. The savings would then be passed on to the reinsurance program.

Prior to the ACA, many states — including Colorado — operated high-risk pools to cover the most expensive customers who could not get coverage because of pre-existing health conditions. But the pools were expensive for both the state and customers, and they covered only a portion of the neediest patients.

High-risk pools were phased out because the ACA required insurance companies to offer coverage to everyone, no matter their health status. But now the high-risk population is back in the spotlight because their disproportionate share of health spending is contributing to rising premium prices for the entire individual market.

Average monthly premiums on the individual market have risen by nearly 80 percent since 2014 and even more in rural Colorado. While the increases have been devastating for some families, insurance companies are not doing well in the individual market, either. State reports show many carriers selling insurance in the individual market lost money from 2014 to 2016, despite their steep annual price increases.¹

Colorado legislators are debating whether a reinsurance program could slow these annual price hikes while ensuring that struggling insurers continue to offer policies. A bill to create a reinsurance program, House Bill 1392, was introduced April 13, 2018.

Recently, Alaska, Minnesota and Oregon have turned to reinsurance programs — which, like high-risk pools, attempt to solve the problem of how to cover people with the most expensive health needs. The Colorado Division of Insurance (DOI) commissioned a study by the actuarial consulting firm Milliman that showed premiums could decrease by nearly a fifth under a well-funded reinsurance program.

The DOI has the responsibility of approving the premiums that insurance carriers can charge for their individual market policies, based on the companies’ projected revenue and expenses. With a reinsurance program, expenses would drop, so DOI regulators would mandate lower prices.

The reinsurance fund would be run by the state, and it would be paid for by federal dollars from the ACA plus fees on perhaps 1 million or more Coloradans with private insurance coverage, most of whom are not on the individual marketplace. The federal government would need to approve an ACA waiver for Colorado to launch the program.

The bigger the reinsurance fund, the better it would work to drive down health insurance premiums. Legislators are considering a large fund of more than $300 million a year.

It’s all about evening out the pain of Colorado insurance customers and the carriers that provide their coverage. Fees on a large group of customers would help pay for significant relief for a smaller number of people in the individual market who have suffered the most from high premiums in the past five years.

This paper gives a basic overview of how a Colorado reinsurance program could work, examines who would and would not benefit from reinsurance, and poses critical questions for policymakers to consider.