When Medical Bills Hit Home

The Colorado Health Institute explores the financial burden of medical bills in our latest brief. This is particularly timely as the nation begins to assess the effectiveness of the Affordable Care Act (ACA) in meeting its goal of limiting the financial exposure to medical expenses.

We analyzed data from the 2013 Colorado Health Access Survey (CHAS) to quantify how many Coloradans had problems paying medical bills, how they addressed those challenges and which Coloradans experienced the most medical debt.

We found that 18.1 percent of Coloradans – about 937,000 people - either had problems paying or were unable to pay their medical bills.

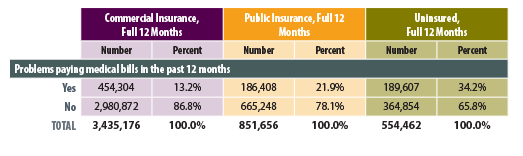

One finding that struck me was that one of five enrollees in public health insurance – Medicaid, Medicare or the Child Health Plan Plus (CHP+) – indicated that they had difficulty paying their medical bills compared with 13.2 percent of people with commercial insurance.

This seems counter-intuitive, since many public insurance beneficiaries pay only minimal amounts for care. And Medicaid, in particular, covers a relatively wide array of services.

So what could be causing this disparity between public and private insurance?

I first considered whether there is a difference between the three programs grouped under “public insurance.” Looking at each individually, I found that about 15 percent of Medicare beneficiaries had medical bill problems. So, the finding seems to be largely driven by Medicaid (24 percent with problems) and CHP+ (28 percent).

A number of other questions crossed my mind:

- Could the problem with medical bills be related to services that aren’t covered by the program? For example, Medicaid did not have an adult dental benefit in 2013 when the survey was administered.

- How long have public insurance respondents been in medical debt? Perhaps the family has been paying medical bills that predate the 12-month look-back window of the CHAS.

- Do these Coloradans have more complex health conditions? I found that 35 percent of people reporting a disability had difficulty paying medical bills compared with 14 percent of those without a disability.

- Might Coloradans who qualify for these programs be more sensitive to any cost-sharing? Enrollees may be more likely to incur debt because they have lower incomes.

Digging deeper into the CHAS and other data sources will help us address these questions. The Colorado Health Institute will continue to examine how the ACA impacts household medical expenses. For example, does the expansion of Medicaid to Colorado adults reduce medical expenses? Are Coloradans taking advantage of financial assistance to reduce copays and deductibles for plans purchased through Connect for Health Colorado? Are Coloradans using the preventive services that private plans are now required to cover?

(A quick note about how the survey asked about medical bills. The CHAS defines medical bills broadly, including bills for doctors, hospitals, dentists, prescription drugs, nursing homes or home care organizations. As for methodology, the CHAS asked if the family – or the individual, in a household of one - had problems paying medical bills for a randomly selected household member in the 12 months prior to the survey.)