Yesterday was Valentine’s Day, and if you follow as many health policy enthusiasts as I do, your Twitter feed was filled with witty #healthpolicyvalentines. One recurring #healthpolicyvalentines theme was medical expenses, such as these tweets:

While these tweets are humorous, they don’t say much about the impact of high-deductibles and co-pays on family budgets.

Almost 750,000 (14 percent) Coloradans reported struggling to pay medical bills in 2017. This is a lot of people, but the percentage has steadily decreased from 2009 when 21.9 percent of people reported struggling to pay their medical bills.

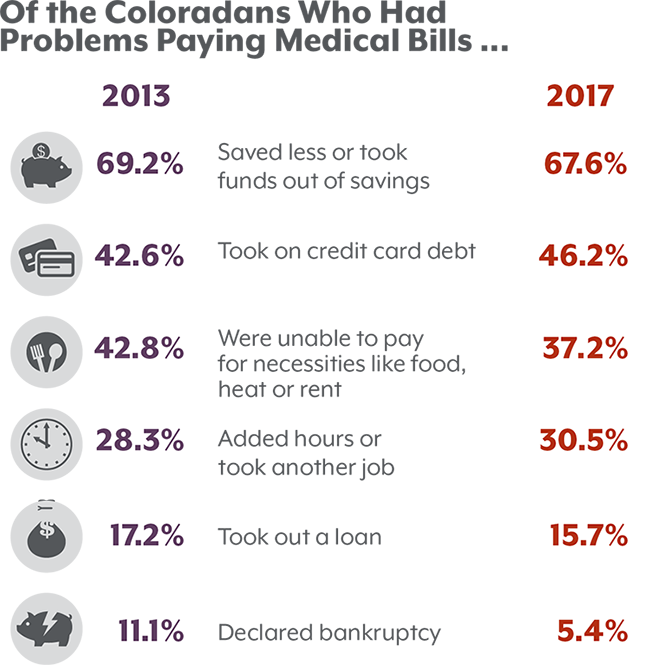

The CHAS dives deeper to ask what spending adjustments these people made so they could pay their medical bills, such as taking out a loan, saving less or taking out of savings, or filing for bankruptcy.

One in seventeen (5.4 percent) people encountering problems paying medical bills report declaring bankruptcy in 2017. Data collected in 2013 showed one of nine (11.1 percent) people reported declaring bankruptcy because of medical bills (2013 was the first year the CHAS asked about medical bankruptcies).

Put another way, more than 100,000 Coloradans declared bankruptcy because of medical debt in 2013. After the Affordable Care Act (ACA) took effect in 2014, that number dropped to about 45,000 in 2015 and held steady in 2017, according to the CHAS.

This trend holds for people who are insured by Child Health Plan Plus, Medicaid, Medicare and private insurance.

The downward trend in the number of people declaring bankruptcy due to medical bills suggests that expansive health policy changes made in 2014 through the ACA may be helping limit extreme medical expenses people face.

The ACA provided subsidies to help families pay for health insurance, removed limits on pre-existing conditions and introduced the individual mandate. Also in 2014, Colorado used ACA funding to expand access to Medicaid, which enabled more low-income people to get health insurance.

Though fewer people report declaring bankruptcy due to medical bills, we have not seen a decrease for other financial actions such as taking on credit card debt.

This suggests that some Coloradans are still having problems paying medical bills, but health policy changes may have reduced the extreme medical bills that lead to bankruptcy.