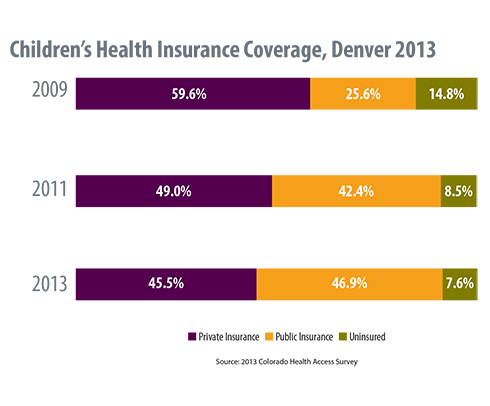

The percentage of children in Denver County who are covered by public insurance nearly doubled between 2009 and 2013, climbing from 26 percent to 47 percent, according to the Colorado Health Access Survey (see graphic.)

This means that one of two kids in Denver County is insured by Medicaid or Child Health Plan Plus (CHP+).

This presentation by Colorado Health Institute research analyst Natalie Triedman highlights the shift in insurance coverage for Denver’s children. She presented the information to Denver Outreach Partners, a group of metro area organizations providing outreach and enrollment efforts for Medicaid and CHP+.

The biggest percentage point change occurred between 2009 and 2011, when the number of kids with public insurance increased 16 percentage points from 26 percent to 42 percent. Colorado’s 2010 expansion of eligibility for CHP+, with family income increasing from 205 percent of the federal poverty level (FPL) to 250 percent of the FPL, likely contributed to the increase, as did the economic recession.

At the same time, coverage by private insurance among Denver children has trended downward from 60 percent in 2009 to 46 percent in 2013. Note that while the increase in public insurance is statistically significant, the decrease in private insurance isn’t, meaning that the change could be due to chance.

These data suggest that as the economy worsened, many children moved from private to public insurance. Overall, the percentage of Denver County children without insurance fell to eight percent in 2013 from 15 percent in 2009.

Denver’s increase in public insurance enrollment among its kids echoes national trends for the general public. A recent report from the Kaiser Family Foundation suggests that post-recession decreases in national uninsurance rates are largely due to increased Medicaid enrollment.

The public policy and budgetary implications of such a profound shift in insurance will be worth studying as we move forward.