Why Churn Happens

Churn is one of those wonky terms used in health policy circles to describe becoming insured or uninsured or changing types of insurance over time. It is an important concept because these transitions can leave people vulnerable to interrupted care or to the financial risk of medical expenses while they are uninsured.

A new brief from the Colorado Health Institute explores the issue of churn in Colorado. We analyzed data from the 2013 Colorado Health Access Survey (CHAS) to answer these questions:

- How many Coloradans churn?

- Are some Coloradans more vulnerable to churning?

- Why do Coloradans churn?

We found that 11.7 percent of Coloradans experienced some type of change in health insurance during the 12 months before the survey. This represents about 605,000 people.

I’m particularly interested in a subset of this population. About 130,000 people – or 2.5 percent of Colorado’s population - are currently uninsured but said that they had been insured at some point in the prior 12 months. What caused them to lose their insurance?

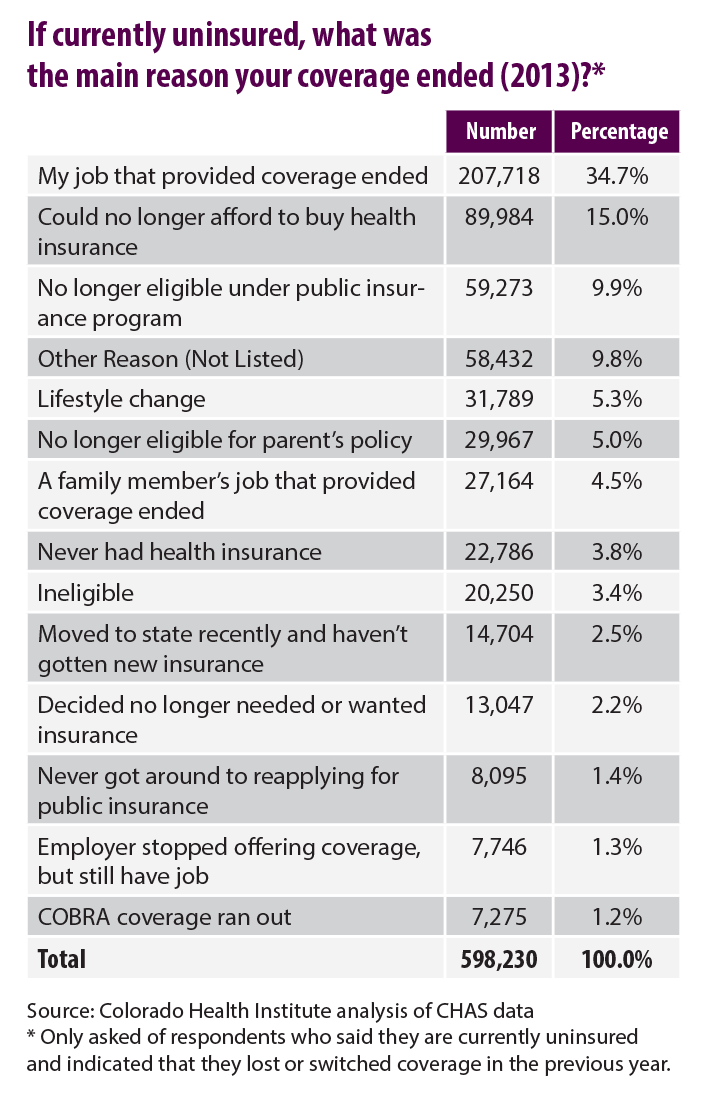

The CHAS is great because the survey not only allows us to measure the WHAT – in this case how many Coloradans lost their insurance – but the WHY as well. The CHAS asked this group to report the main reason that their coverage ended. It turns out that more than one in three people in this group – 34.7 percent – indicated that the job that provided their coverage ended. The second highest reason given was that they could no longer afford to buy health insurance (15.0 percent). Another 4.5 percent indicated that a family member’s job that provided coverage ended.

The fact that more than half of Coloradans who lost their insurance pointed to unaffordability or the loss of a job was not particularly surprising to me. In general, most Coloradans are covered through their employer, and the CHAS found that the majority of uninsured Coloradans indicate that cost is the biggest reason they lack coverage.

What was more surprising was that some of the other reasons given were not higher. Only 1.3 percent said that their employer stopped offering insurance. Another 2.2 percent indicated that they no longer needed or wanted insurance. About 11 percent said that they were no longer eligible under a public insurance program or had not gotten around to re-applying.

Granted, churn is a complicated issue. Many of these reasons are interrelated and the survey forced respondents to choose just one. The discussion is also not complete without examining Coloradans who gained or switched insurance and why. This was also the first time that the CHAS included items about churn.

Although we can’t look back at how churn has changed, it is more important to be able to look ahead. The issue continues to be of interest to policymakers. Colorado recently implemented a provision that allows children to be continuously enrolled in Medicaid for 12 months instead of having to be recertified each month. Churn between insurance types may be further complicated by eligibility rules between Medicaid and financial assistance eligibility on Colorado’s new marketplace, Connect for Health Colorado. Under the ACA, individuals and families with incomes above the Medicaid threshold – between 139 and 400 percent FPL – are eligible for tax credits to help purchase private health insurance. But Medicaid eligibility for adults is determined monthly and the tax credits are determined annually, potentially complicating insurance purchases.

The CHAS provides invaluable baseline information for examining churn over time. The data will provide insight into the impact of these policy changes and, most importantly, how Coloradans are experiencing them. Stay posted.