The ACA and Hospital Profits

The ACA includes a number of provisions designed to provide incentives for health care quality in Medicare. Hospitals with particularly high re-admissions rates, meaning that they discharge a high number of patients who return to the hospital in less than a month, can be penalized through reductions in Medicare rates. Some industry watchers worry that these penalties may negatively impact hospitals’ bottom line. Given the large role hospitals play - they account for approximately $19 billion of Colorado’s economy - it’s an important sector to watch.

While many of these provisions weren't implemented until 2012, new data suggests that prior to this policy change, hospitals in the Denver metro area were faring well.

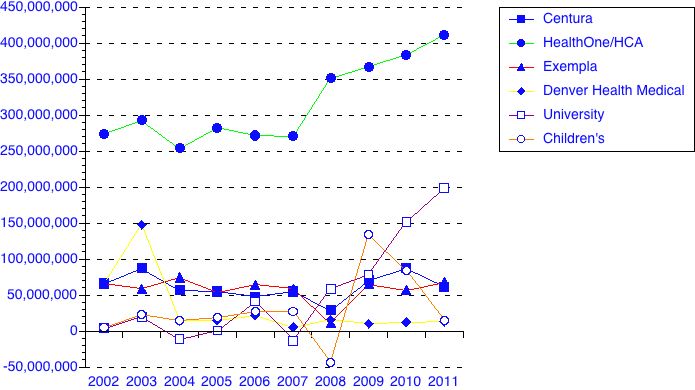

According to the latest Colorado Health Market Review, published by consultant Allan Baumgarten, hospitals in the metro Denver area had pre-tax net income of 12.3 percent of net patient revenue in 2011. HealthOne/HCA led the pack with a 22.9 percent margin, followed by Exempla at 6.8 percent and Centura at 5.6 percent.

Here is a chart of net incomes for the major hospitals systems in Colorado:

<

Baumgarten’s report also looked at hospital capacity. Despite the fact that inpatient occupancy rates have declined (from 69 percent in 2008 to 66 percent in 2011), the hospital industry in the metro area is expanding its infrastructure. According to Baumgarten, over the past ten years, seven new or replacement hospitals have been built in the area. Even with the movement toward including more preventive benefits in health insurance plans, hospitals are anticipating an influx of patients, especially with 530,000 currently uninsured Coloradans expected to gain insurance because of federal health reform.

HMOs have fared well, too. In 2012, HMOs in Colorado recorded after-tax net income of 4.2 percent of underwriting revenues. According to the report, Medicare Advantage plans comprise the largest proportion of HMO net income. Those positive figures are likely to continue at least in the short-term. The Obama administration recently reversed its plan to reduce Medicare Advantage payments to insurers by 2.2 percent in 2014. Instead, they will be receiving a 3.3 percent increase.

The jury’s still out on the extent to which the new law will impact hospitals' financial health in the long term. In the coming years, CHI will monitor data sets - such as this one - to better understand these trends.