Methodology

The Colorado Health Institute (CHI) based this analysis on data published by the Colorado Department of Health Care Policy and Financing (HCPF) in December 2015. CHI made additional projections or assumptions about these data as necessary for this analysis. The assumptions are detailed here.

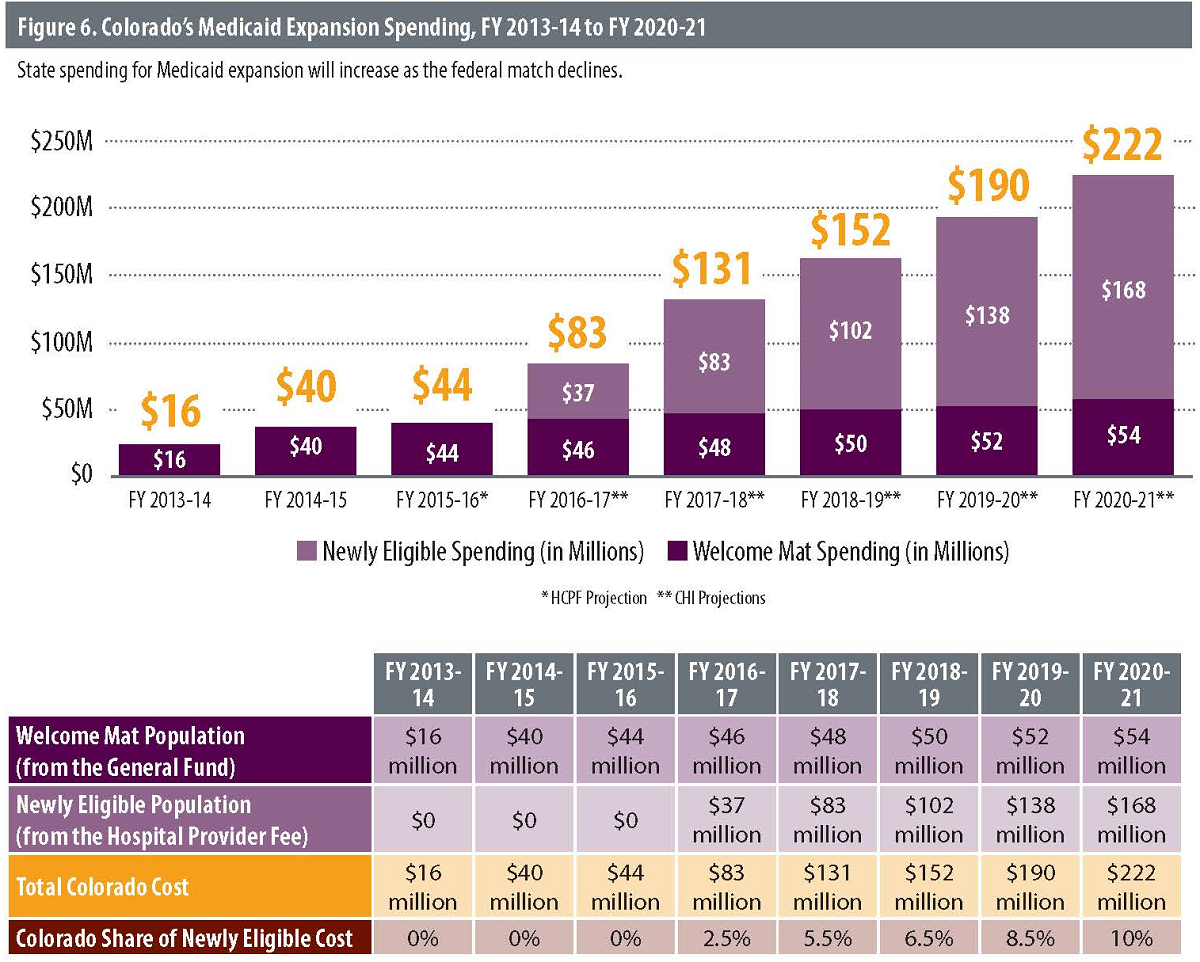

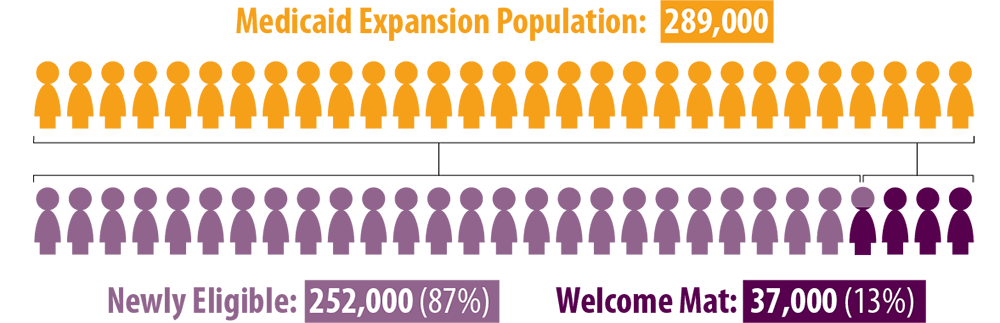

HCPF has published projections of expansion population costs and enrollment that distinguish between the welcome mat and newly eligible populations only through FY 2015-16. CHI projected the costs from FY 2016-17 through FY 2020-21 based on two assumptions: that spending for welcome mat enrollees will grow at an annual rate of 3.8 percent, the growth rate predicted for the non-expansion population between FY 2015-16 and FY 2016-17; and that spending on newly eligible enrollees will grow at an annual rate of 3.5 percent, the spending growth rate that HCPF projects for this population between FY 2015-16 and FY 2016-17.

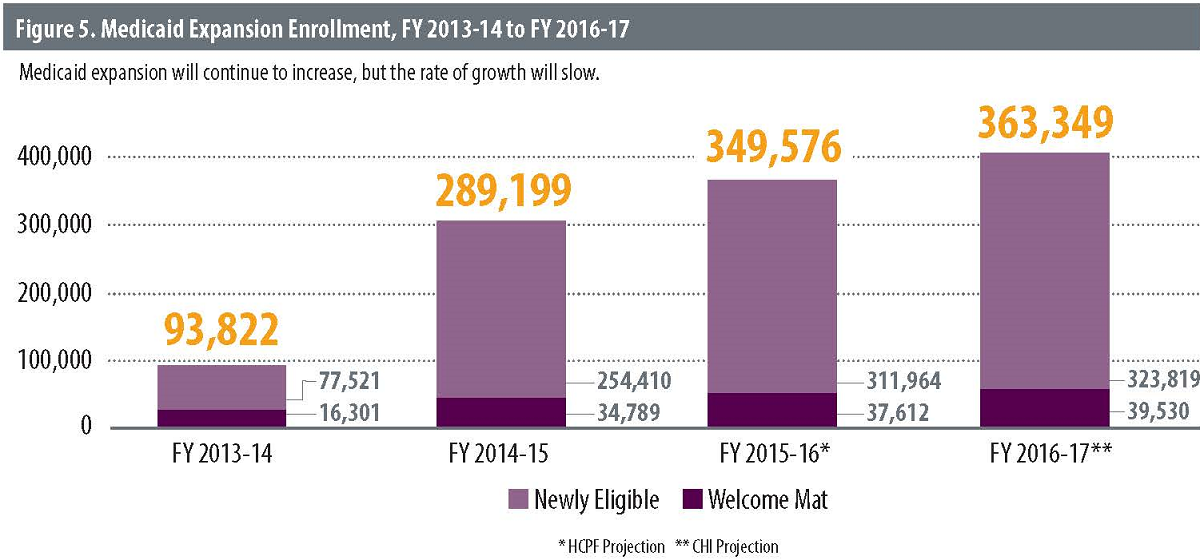

CHI projected additional Medicaid enrollment through FY 2016-17 based on two assumptions: that enrollment for the welcome mat population will grow at an annual rate of 5.1 percent, the same projected growth rate of the non-expansion population between FY 2015-16 and FY 2016-17; and that enrollment for newly eligible enrollees will grow at an annual rate of 3.8 percent, the same growth rate projected for this population between FY 2015-16 and FY 2016-17.

CHI used HCPF data from December 2015 in this analysis. In a later analysis, from February 2016, HCPF revised upward its estimated Medicaid caseload.

However, for consistency, the data used by CHI in this analysis are based on HCPF’s responses to the Joint Budget Committee on December 16, 2015.

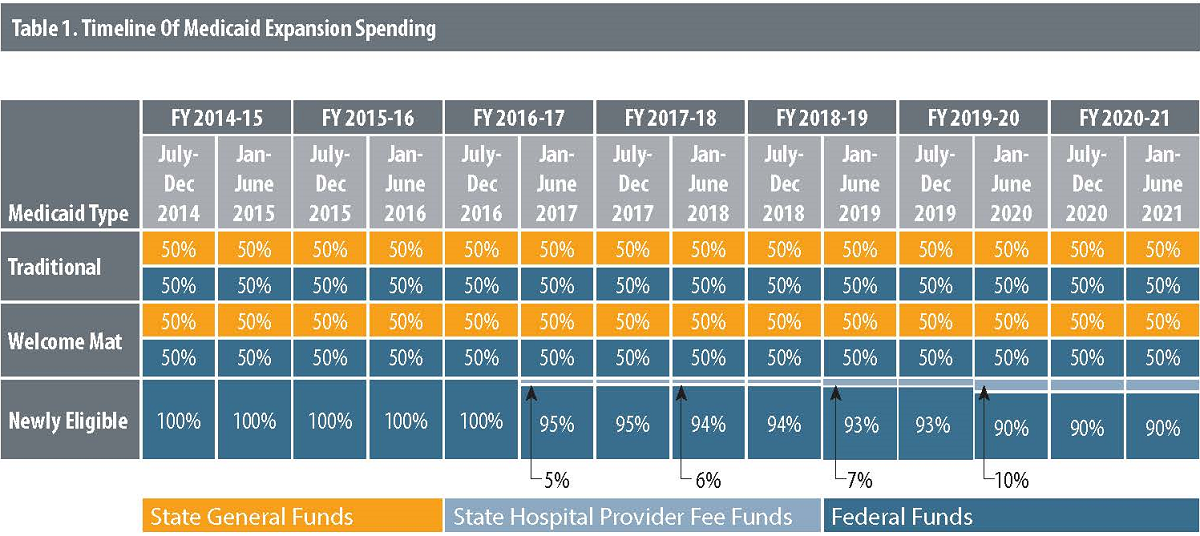

In a few instances, CHI made additional assumptions regarding federal-state match rates related to Medicaid expansion payments.

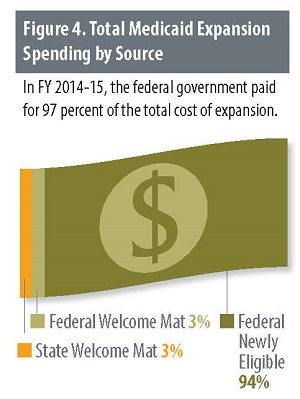

This analysis assumes a 100 percent federal match rate for all newly eligible enrollees. In reality, HCPF estimates that a tiny portion of the newly eligible population— 0.5 percent — hovered near the pre-expansion eligibility level and most likely would have qualified for Medicaid with the extra step of undergoing an “assets test.”The federal government pays 87.7 percent of the cost of this population rather than the 100 percent for other newly eligible enrollees.

CHI assumes a 50 percent federal match for welcome mat enrollees, which has been the case in Colorado for some time. The federal match, however, is subject to change because it is based on the ratio of state per capita income to the average national per capita income. Kaiser Family Foundation estimates Colorado’s match is now 50.7 percent and that it will vary between 50 and 51 percent in the next few years.18

Colorado’s Hospital Provider Fee fund covered the cost of the state’s match for a small portion of the welcome mat population that gained eligibility under Colorado’s earlier Medicaid expansion but was not included in

the ACA expansion — namely, parents and caretakers between 60 and 68 percent of the FPL and children on continuous eligibility, meaning their Medicaid coverage remains intact even if their family experiences a change in income during the year. This analysis, however, makes the assumption that these small populations are in the standard ACA “welcome mat” group that receives its match from the state’s General Fund.

In the box titled “Medicaid: A Primer,” CHI cites eligibility guidelines before and after expansion. These eligibility levels reflect new methods of calculating income under the ACA and modified adjusted gross income (MAGI).

Because this change did not go into effect until January 1, 2014, pre-expansion regulations display the criteria for children as at or below 133 percent of the FPL and the criteria for pregnant women as at or below 185 percent of the FPL. This differs from post-expansion regulations, which display the criteria for children as at or below 147 percent of the FPL and the criteria for pregnant women as at or below 200 percent of the FPL. Despite this, the eligibility for these two groups did not actually change under the ACA expansion.

Finally, certain populations defined as welcome mat or newly eligible by HCPF were defined differently by CHI.

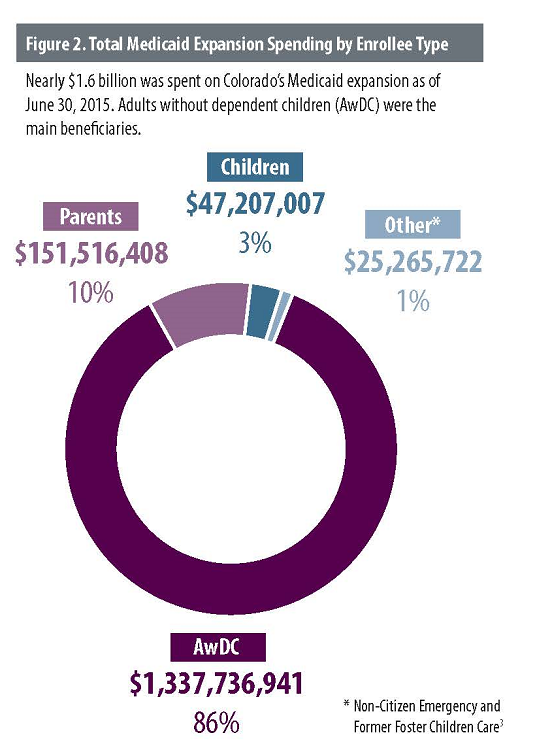

While foster care and non-citizen emergency populations technically include some people who are newly eligible, they are all matched at the standard 50 percent federal rate for welcome mat enrollees. For simplicity, the CHI analysis considers all spending for these populations, which is about $20 million per year, to be welcome mat spending.

Additionally, a portion of what HCPF calls the welcome mat population — parents and caretakers with annual incomes between 69 and 100 percent of the FPL — receive a 100 percent federal matching rate. CHI, for purposes of this analysis, considered these populations to be newly eligible.

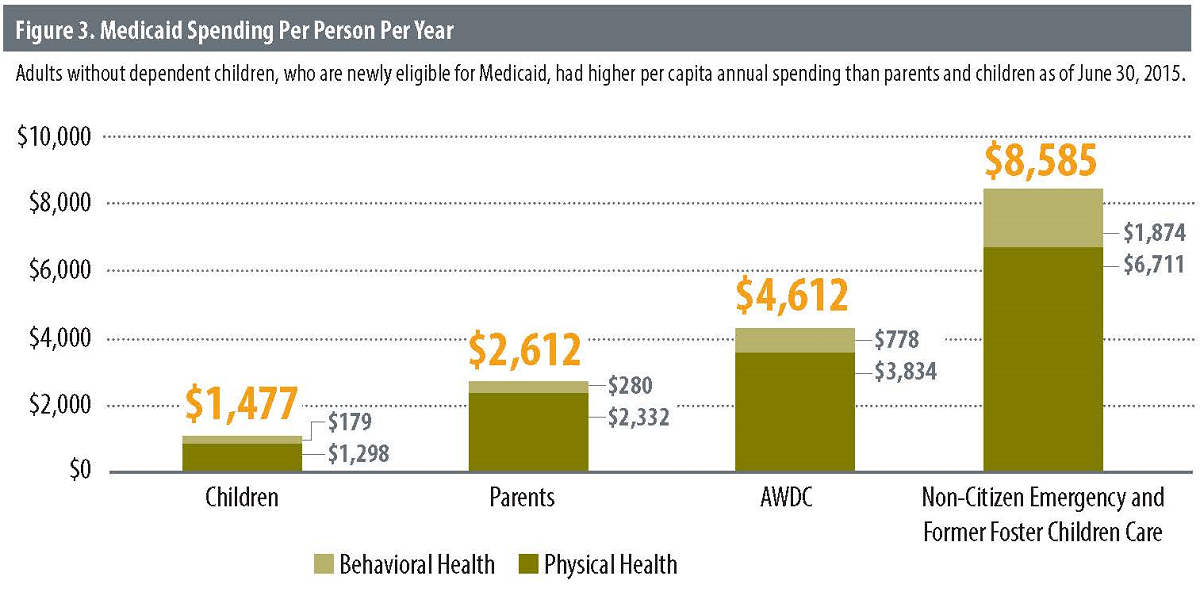

On average, each expansion enrollee — both newly eligible and welcome mat enrollees — cost approximately $4,100 annually in the first two years. Projections had anticipated spending approximately $5,200 per enrollee.

On average, each expansion enrollee — both newly eligible and welcome mat enrollees — cost approximately $4,100 annually in the first two years. Projections had anticipated spending approximately $5,200 per enrollee.

New Expectations: The Next Two Years

New Expectations: The Next Two Years