Challenges Facing Amendment 72

Reducing tobacco and nicotine use among Coloradans may be challenging even with passage of Amendment 72.

The use of e-cigarettes, almost unheard of five years ago, has skyrocketed recently in Colorado and across the country. These battery- powered devices vaporize a nicotine-filled liquid that can be inhaled, allowing users to get their nicotine fix without having to light up a cigarette.

Among US high school students, e-cigarette use jumped from 1.5 percent in 2011 to 16 percent in 2015. In Colorado, high school use is even higher at 26.1 percent, according to the Healthy Kids Colorado Survey.

Little research has been done on the long-term effects of vaporizers. They are thought to contain fewer harmful ingredients than cigarettes, but have been found to contain carcinogenic chemicals, including antifreeze and formaldehyde.

Because e-cigarettes are not regulated as a tobacco product in Colorado, they are not subject to tobacco taxes. As a result, their prices would not be impacted by Amendment 72. There is limited research on whether smokers would switch to e-cigarettes as an alternative to cigarettes.

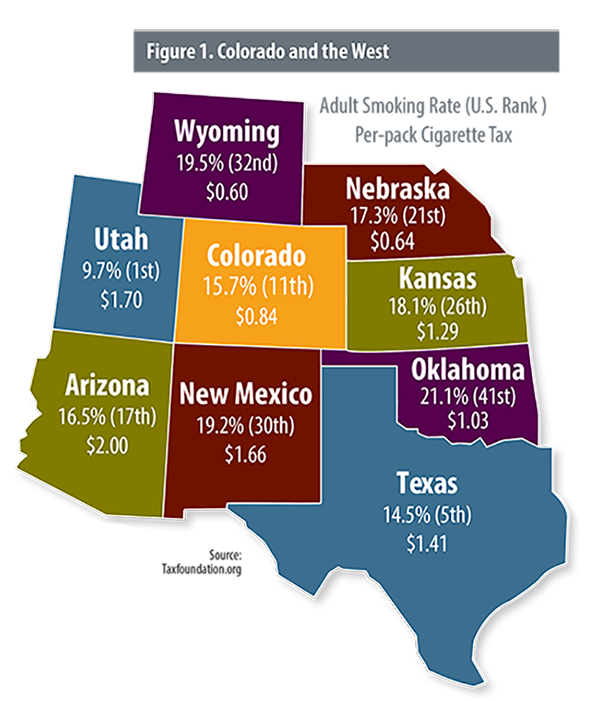

Another challenge could come from outside Colorado. If Amendment 72 passes, Colorado will have the highest tax of any surrounding state. This raises the possibility that more cigarettes will come in from Wyoming, where the cigarette tax is just 60 cents a pack, or another state. These un-taxed cigarettes could cut into Colorado’s tax revenues.

As one example, New York has the highest cigarette tax in the nation at $4.35 per pack. And 56.9 percent of the cigarettes consumed there are purchased from other states.

Potential Impact on Low-Income Coloradans

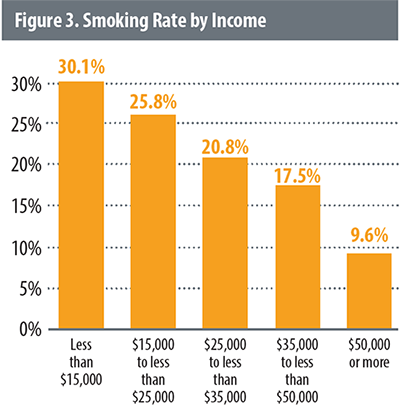

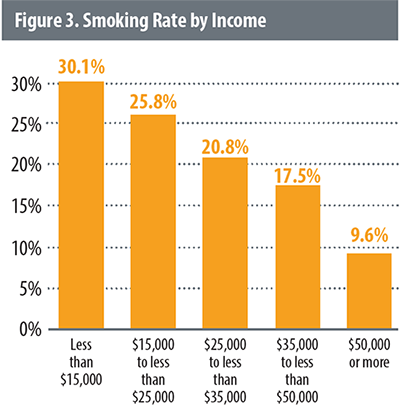

Tobacco taxes have a greater impact on low-income people because they are more likely to smoke. Of Colorado adults earning less than $15,000 a year, three of 10 are smokers. Only one of 10 Colorado adults making more than $50,000 a year is a smoker, according to the Behavioral Risk Factors Surveillance Survey. Research, however, suggests that lower-income smokers are also more likely to quit or limit consumption in response to price increases.

Tobacco taxes have a greater impact on low-income people because they are more likely to smoke. Of Colorado adults earning less than $15,000 a year, three of 10 are smokers. Only one of 10 Colorado adults making more than $50,000 a year is a smoker, according to the Behavioral Risk Factors Surveillance Survey. Research, however, suggests that lower-income smokers are also more likely to quit or limit consumption in response to price increases.

Revenues from Amendment 72 would support Health First Colorado (Colorado’s Medicaid program), which is required by the Affordable Care Act to provide smoking cessation services to its members.

New tax revenues are earmarked to support Community Health Centers and health care providers serving low-income patients, which could benefit low-income populations.

Cigarette Tax Revenue: Where It Would Go

Proponents of Amendment 72 estimate that it will bring in $315.7 million a year to be distributed to seven health-related areas. (see breakout box). Colorado’s Legislative Council, the legislature’s nonpartisan research arm, estimates it would bring in closer to $299 million a year due to the likelihood that increasing the tobacco tax will reduce sales. Whatever the amount, the amendment specifies that revenues would be exempt from the state’s Taxpayer’s Bill of Rights, which limits the annual growth in revenue.

Taxes collected during the state’s 2015-16 budget year under Amendment 35 totaled $200.3 million. Of that, $143.7 million went to health-related programs and the remainder to state and local programs.

Taxes collected during the state’s 2015-16 budget year under Amendment 35 totaled $200.3 million. Of that, $143.7 million went to health-related programs and the remainder to state and local programs.

Opponents of Amendment 72 argue that the amendment doesn’t spell out in detail which programs would receive funding from the tax.

It is true that specific programs are not identified in Amendment 72. Instead, legislation would be needed to direct where the money would go, giving lawmakers a chance to weigh in. Similar legislative oversight has been used to allocate revenues from Amendment 35.

All programs will be administered by either the Colorado Department of Public Health and Environment (CDPHE) or the Department of Health Care Policy and Financing (HCPF).

For instance, institutions applying for research funding to study tobacco’s effects on health would have to apply for a grant through CDPHE. The applications would then be peer reviewed and evaluated for scientific merit and potential conflicts of interest.

If smoking rates decreased, tax revenues would also decrease. This means that program funding for these programs is directly related to the amount of tobacco products being purchased.

Proponents

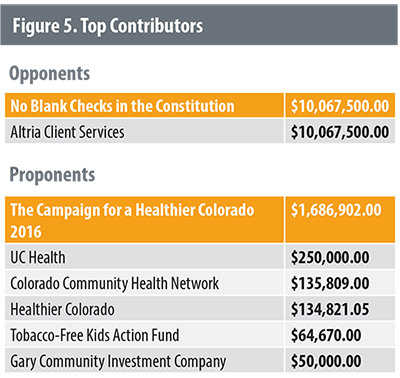

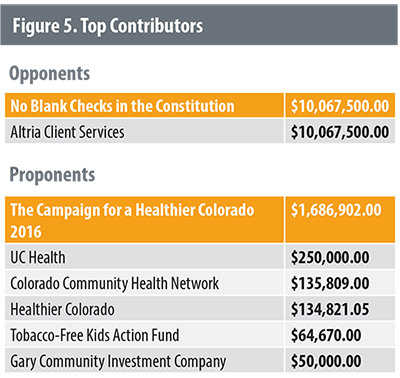

Amendment 72’s proponents include a wide array of health organizations, including the American Cancer Society, American Lung Association, American Heart Association and Colorado Medical Society. Also supporting the amendment are veterans’ groups, hospitals and philanthropic health foundations. A number of organizations have contributed to the pro-Amendment 72 campaign, but they have been vastly outspent by the opponents.

Colorado Governor John Hickenlooper has said he supports Amendment 72 and its mission to save lives, but says he might have preferred a smaller tax increase.

The 2016 State Ballot Information Booklet, known as the Colorado Blue Book, identifies the following arguments in support of Amendment 72:

- Tobacco product consumption is responsible for 5,100 deaths in Colorado every year. Higher tobacco prices have been shown to deter tobacco use, especially among children and young adults, and following the implementation of Amendment 35, the number of cigarettes consumed per person dropped by 12.6 percent.

- By dedicating tobacco tax revenue to programs that will further decrease the use of tobacco products, Amendment 72 would improve the health of Coloradans while helping to offset the $1.89 billion cost of tobacco related disease.

Opponents

The opposition to Amendment 72 is being headed by a committee calling itself No Blank Checks in the Constitution. Altria Client Services, a subsidiary of the tobacco producer Altria, has contributed $10 million. It is the campaign’s only contributor.

The 2016 Colorado Blue Book identifies the following arguments against Amendment 72:

- Amendment 72 would unnecessarily lock $315 million into constitutional spending with little to no accountability or oversight. The amendment does not identify specific programs that would receive funding, and taxpayers would not have a say in where this money would go.

- Low income individuals are more likely to use tobacco products and would take the brunt of the tobacco tax increase. With less disposable income to spend, Amendment 72 would be a burden on low income Coloradans.

In addition to tripling the cigarette excise tax, Amendment 72 would also increase the tax on other tobacco products such as cigars and chewable tobacco from 40 percent to 62 percent of the manufacturer’s price. This means that for every dollar a tobacco manufacturer charges for its product, 62 cents would go to the state.

In addition to tripling the cigarette excise tax, Amendment 72 would also increase the tax on other tobacco products such as cigars and chewable tobacco from 40 percent to 62 percent of the manufacturer’s price. This means that for every dollar a tobacco manufacturer charges for its product, 62 cents would go to the state. However, the effects of a tobacco tax increase diminish over time. Between 2010 and 2015, Colorado’s adult smoking rate decreased just .4 percentage points from 16 percent to 15.6 percent while national rates continued to decline.

However, the effects of a tobacco tax increase diminish over time. Between 2010 and 2015, Colorado’s adult smoking rate decreased just .4 percentage points from 16 percent to 15.6 percent while national rates continued to decline. Tobacco taxes have a greater impact on low-income people because they are more likely to smoke. Of Colorado adults earning less than $15,000 a year, three of 10 are smokers. Only one of 10 Colorado adults making more than $50,000 a year is a smoker, according to the Behavioral Risk Factors Surveillance Survey. Research, however, suggests that lower-income smokers are also more likely to quit or limit consumption in response to price increases.

Tobacco taxes have a greater impact on low-income people because they are more likely to smoke. Of Colorado adults earning less than $15,000 a year, three of 10 are smokers. Only one of 10 Colorado adults making more than $50,000 a year is a smoker, according to the Behavioral Risk Factors Surveillance Survey. Research, however, suggests that lower-income smokers are also more likely to quit or limit consumption in response to price increases.