Insurance Instability to Continue in 2017

Thousands of Coloradans will see higher prices and fewer choices for health insurance next year.

The state Division of Insurance (DOI) on Monday revealed the premium rates that insurance companies want to charge on the individual and small group markets in 2017. The news is grim, at least on the individual market. Some of the headlines:

- Four carriers are pulling out of the individual market or greatly scaling back, forcing 92,000 people to change their insurance plans for 2017.

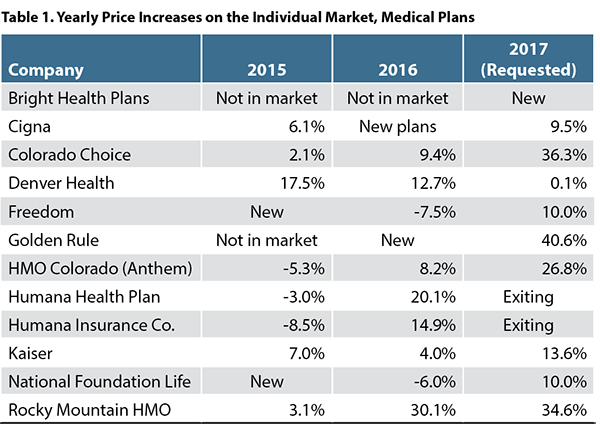

- Premium price increases range from high to breathtaking. Cigna is seeking an average 9.5 percent increase, while Rocky Mountain Health Plans is asking for 34.6 percent more. (See Table 1 for a list of price changes by carrier.)

- Western Slope residents once again are likely to have it worst, with the highest prices and fewest choices.

There’s good news, too. The small group market is holding steady, with roughly the same number of plans and either price cuts or modest increases. Denver Health’s average rates will be virtually unchanged after two years of double-digit price increases. And a new carrier, Bright Health Plans, could pick up some of the slack left by companies abandoning the market.

Still, it’s hard to sugarcoat these numbers. The rising prices pose a challenge to the Affordable Care Act (ACA), which sought to use competition on the individual market to drive down the cost of coverage.

The increases make it likely that a growing number of Coloradans will no longer be subject to the ACA’s mandate to buy insurance coverage. People are released from the mandate when the cheapest available plan costs more than 8.05 percent of their income. Rates in some regions Colorado are set to rise much faster than incomes will grow. If insurance becomes unaffordable, Colorado could start to see a reversal in the major gains it has made in reducing the uninsured rate since passage of the ACA.

The latest news points to a second straight year of turmoil in the individual market. Late last year, the Colorado HealthOP shut down, leaving 80,000 people without coverage heading into the third open enrollment under the ACA. Next year, 92,000 people will have to find new coverage during the fourth open enrollment after their plans shut down.

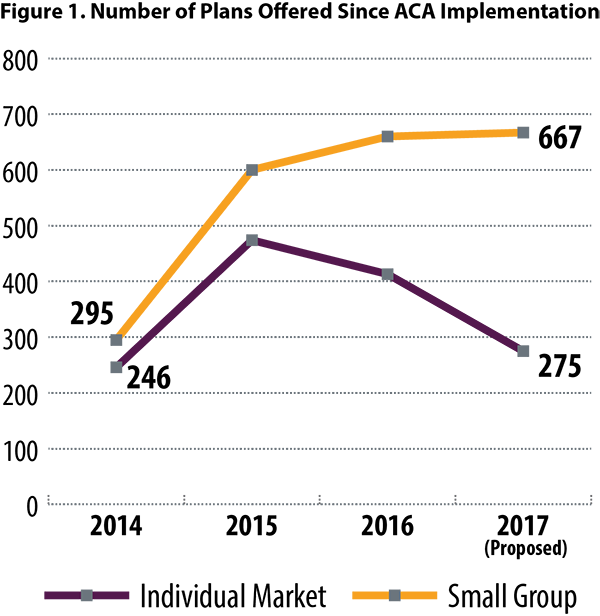

Insurance companies initially rushed to respond to the ACA. The number of plans mushroomed in 2015, and there was fierce price competition. Competition on the small group market still looks healthy. But the number of plans offered on the individual market started dwindling in 2016, and it’s set to plummet next year (See Figure 1).

Carriers cite a few reasons for the price increases. New customers on the individual market have been more expensive to cover than predicted. Also, companies next year will no longer get help from an ACA transitional program that shared the cost of insuring new people.

Big players in Colorado are throwing in the towel. UnitedHealthcare and Humana Insurance will not participate in the individual market next year. Rocky Mountain Health Plans will sell policies only in Mesa County. And Anthem Blue Cross Blue Shield is ending is preferred provider organization (PPO) plans, although it still will offer health maintenance organization (HMO) plans.

Rocky’s retrenchment to Mesa County will leave Anthem’s HMO as the only choice for people in parts of the Western Slope, according to the DOI. At the same time, Anthem is proposing an average 26.8 percent price increase for its HMO plan. That means some Western Colorado residents will face price increases in excess of 25 percent for the second straight year.

Dental Plans Plummet

Coloradans will have fewer choices when it comes to dental plans as well.

Carriers propose to offer 51 dental plans in 2017, down from 150 in 2016. That means there will be 99 fewer plans next year, with the small group market taking the biggest hit.

- Of the 51 plans submitted for next year, 17 are proposed for the individual market, down from 23 in 2016. Delta Dental of Colorado is offering five of those individual plans, all on the exchange, the most in Colorado.

- In the small group market, the number of dental plans will fall to 34 in 2017 from 127 in 2016. That’s a decline of 93 plans.

- Twelve dental plans for individual market consumers will be offered through Connect for Health Colorado, unchanged from 2016.

Some Caveats

Health insurance can be highly confusing, so it’s important to note two points.

First, these rates are what the carriers requested. The DOI will review them and issue final rates in September or October.

Second, these rates affect a minority of Coloradans — those who purchase insurance on the individual or small group markets. An estimated 450,000 Coloradans buy coverage through the individual market, according to the Colorado Health Access Survey. Another 214,000 were in the small group market in 2014, according to the DOI. By comparison, around 2.5 million Coloradans receive their insurance through a large employer.

Members of the public can comment on the rates through July 6. See the DOI's health insurance page for details.